10 Holiday Budgeting Tips for the Savvy Shopper

At no additional cost to you, as an affiliate of Amazon and other organizations, I may earn money or products from the companies mentioned in this post. When you use my links, you also support this single mom. Thanks! Read the privacy policy and disclosure here.

Take control of holiday budgeting…

The holiday season is the season of giving. That often translates to “spend money.” If your holiday gift list seems to get longer every year as mine does, then that just means your holiday budgeting has to get more on-point. After all, it’s better to give than to receive, right?

Being the savvy shopper you are, you’re here because you’re thinking ahead so holiday spending doesn’t take you under. Well, you’ve come to the right place. I’ve put together 10 holiday budgeting tips for the savvy shopper to help you save money, stay organized, and help you enjoy the holiday season without regret.

Related: 10 UNDENIABLE REASONS TO LOVE THE GREENLIGHT CARD FOR KIDS

1. Set a spending limit

The first step in budgeting is setting a spending limit. Having this limit will help you reduce holiday spending so you don’t have regrets later.

It helps to use the 50-20-30 rule. What is the 50-20-30 rule? It’s a way of allotting how much money you can spend on necessities, savings, and everything else.

For this rule, the split is as follows:

- 50% for essentials

- 20% into savings

- 30% for everything else

There are many budgeting rules out there. I find this one very easy to remember and stick to.

To make it easy for you, I’ve created a free printable Holiday Budget Worksheet so you can set budgets for everyone on your list. You can download the Holiday Budget Worksheet completely free, here!

2. Create a list

In addition to setting limits to reduce holiday spending, you need to set a limit to who can be on your holiday list. It won’t work out too well if you have a small holiday budget, and 50 people on your list.

Remember, not everyone needs to receive a gift from you to know that you care. Homemade cards work just as well. When choosing who gets a gift, my rule is the kids come first, adults are secondary. From there, I choose my closest family members. If I have money left in my budget, I include close friends, teachers, and anyone else that made a difference in my life during the year.

Remember, download my free Holiday Budget Worksheet to easily sort your list.

3. Save your money

In order to stick to your budget, you need to save your money. The earlier you start, the better. There are many ways to cut your spending during the year so you have more money left over to buy gifts.

One method I use to save money, is by getting cash back for things that I am buying anyway. Here are my go-to’s:

Ibotta

When I go grocery shopping, I use the Ibotta. It’s a free app that gives cash back for your shopping. They have online options, but I primarily use it for my in-store shopping. I scan my receipts and earn money back for items I bought that are eligible for cash back.

So far, I’ve earned over $800 cash back! Use this link to get the app and earn a $10 bonus when you scan your first receipt!

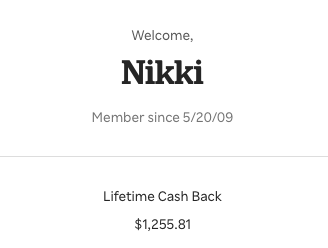

Rakuten

I don’t shop online without using Rakuten for cash back. Rakuten is an app and a website that gives you money back just for using them to go to the website and shop as you normally would. It even works when ordering for store pickup.

Use this link to sign up for Rakuten, and get up to a $30 bonus when you use Rakuten to make a purchase!

Upromise

Upromise is a free college savings program. I can choose to get a check or have my earnings put into my daughter’s college savings accounts. My daughter has THOUSANDS of dollars in college money just from my online shopping! See my post, How I Earn College Money by Shopping.

I primarily use Upromise for cash back when eating at restaurants, when I purchase gasoline, and some of my online shopping. Sometimes Upromise gives larger cash back than Rakuten, so I use what gets me the most money back. I linked my credit cards so my in-store cash back is awarded automatically.

4. Earn Free Gift Cards

You’re reading that correctly. It is possible to earn free gift cards and use them for everything from necessities to holiday gifts.

I earn hundreds of dollars in free gift cards every month by using apps or websites for:

- Scanning receipts

- Playing games

- Referring friends

- Answering surveys

- And other easy tasks!

I use a lot of them, but here is a quick rundown of my faves:

- Fetch Rewards – This app gives instant free gift cards for scanning receipts. Sign up and scan your first receipt for 2,000 bonus points!

- InstaGC – Get cash and gift cards for watching videos, playing games, and more on their website. They pay instantly!

- MyPoints – Get free gift cards or cash via Paypal for watching videos, scanning receipts, and more! Some gift cards are instant!

- Swagbucks – Use their app or website to answer surveys, watch videos, and more. Loads of gift cards are available!

- InBox Dollars – This app/website is an easy way to earn cash for scanning receipts, watching videos, and so much more!

There’s more where that came from! See my free gift cards playlist on YouTube for dozens of other legit ways to get free gift cards!

[embedyt] https://www.youtube.com/watch?&width=1140&height=641&listType=playlist&list=PLVtZhIoBI0R-o7KwUPHm3EVwxx3DD1ZFh&plindex=0&layout=gallery&gallery_style=carousel&gallery_thumbcrop=box[/embedyt]Related: THE BEST APPS TO EARN FREE GIFT CARDS!

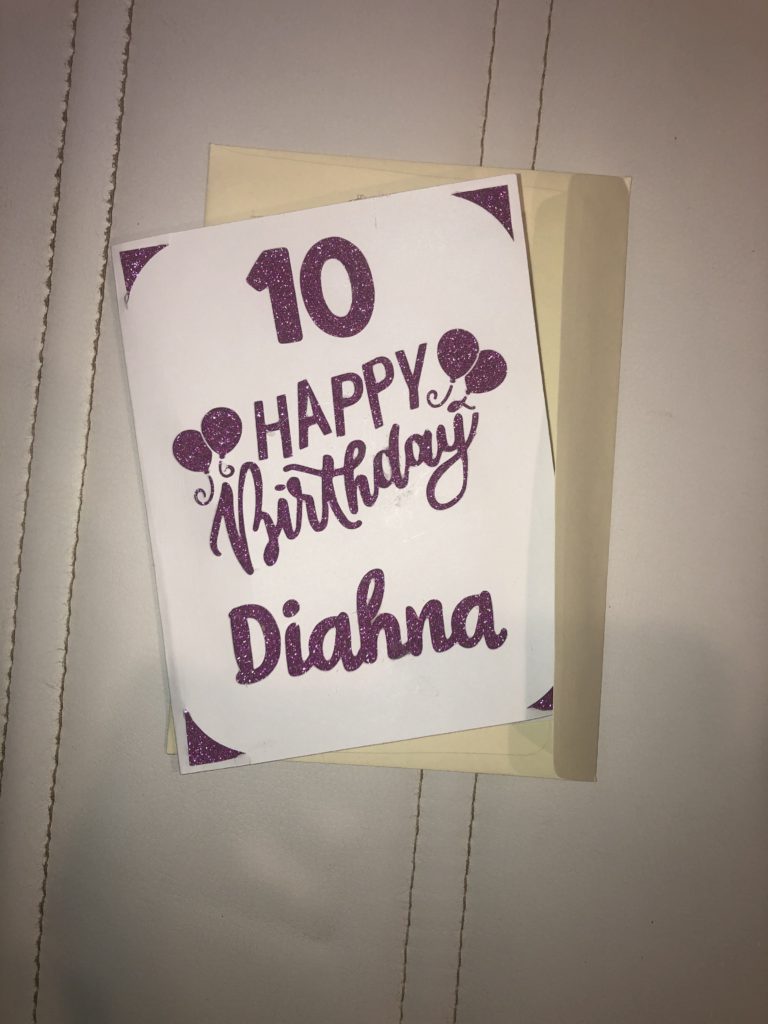

5. Make gifts

Giving someone a gift your made means so much more than giving a gift you bought. Taking the time for a custom gift shows you are willing to put in effort for that person, and it saves money!

For this reason, I have a Cricut Maker machine. This machine can make so many custom items such as Christmas cards, party decorations, and even purses!

I have even created things using my Cricut Maker and sold them on Etsy to make extra money from home. See where I’m going here?

Watch how I used my Cricut Maker to help create my custom DIY photo booth!

6. Use coupons

Yet another way to help you save money…coupons. Coupons don’t have to be in paper form, many stores offer digital coupons these days. But many people don’t use them because they don’t know how to use them. Here’s some incentive to learn:

For every hour I spend couponing, it typically saves me at least $50!

Most Americans do not make $50 an hour. So, you gain more in an hour of couponing than you do for going to your job. Think about it.

Free coupons are available right here on this website. And to make understanding couponing easy, check out any of these posts. Or see it in action, shop with me in this video:

[embedyt] https://www.youtube.com/watch?v=7tj767prJ5I[/embedyt]7. Black Friday and Cyber Monday Sales

One of the most-used holiday budgeting tips is to shop during Black Friday and Cyber Monday. Black Friday is traditionally the day after Thanksgiving, and Cyber Monday (online sales) is the following Monday. Although, stores, like Walmart, have been known to push Black Friday up to earlier dates.

While Black Friday is often remembered for huge crowds and angry customers, I take a different approach to this sale day. I shop online. More and more companies have been moving their Black Friday sales online. So, there’s no need to even go out to the store.

Remember, to use Rakuten to get cash back for online purchases during these sales. They often double the cash back for many stores.

8. Shop Now!

Don’t wait to do your holiday shopping. By now, you may have heard that many businesses are experiencing shortages. This is causing huge delays getting packages shipped. And if you’re like me, and do some of your holiday shopping online, you want to get it done early so your packages arrive on time.

Waiting to shop can also end up costing you more money. Shipping costs go up, and stores will often raise their prices closer to the holidays. They want to cash in on our procrastination. Don’t get caught in that net.

8. Save your decorations

One way to easily waste money is to buy your holiday decorations every year. Save your money and invest in some storage containers, an ornament storage box, and a Christmas tree storage bag if you use a faux tree.

Storing your decorations will not only save you money from buying more than you need to, but it will also save you time you may spend shopping for that decor.

8. Get Last Year’s Version

Companies are constantly coming out with newer versions of the same product. (I feel like iPhone comes out with a new version twice a year). During the holidays, these newer products often fly off the shelves, and the previous edition is sold at a reduced price.ff

You’d be surprised how much money you can save on electronics and more if you decide to be the first kid on the block with the new toy. Especially with video games, phones, computers, and even kitchen appliances. And let’s face it, many times new products are released and they have bugs and glitches that need to be improved upon.

Plus, the previous version of the product often has cool features. So, as long as it’s an upgrade to what you or your gift recipient have, you can still come out on top with a slightly older version. The Amazon Echo Show 8 can be just as useful as the Echo Show 10.

9. Limit Credit Card Use

Try not to put your holiday expenses on a credit card unless:

1. You already have the money to pay it back.

2. The card has a benefit such as cash back or accumulates rewards points.

Otherwise, you may find yourself overwhelmed after the holidays trying to balance the holiday bills, and your typical bills. Just remember, to utilize the cash back from Rakuten. The rebates for holiday shopping come in February. That always comes in handy.

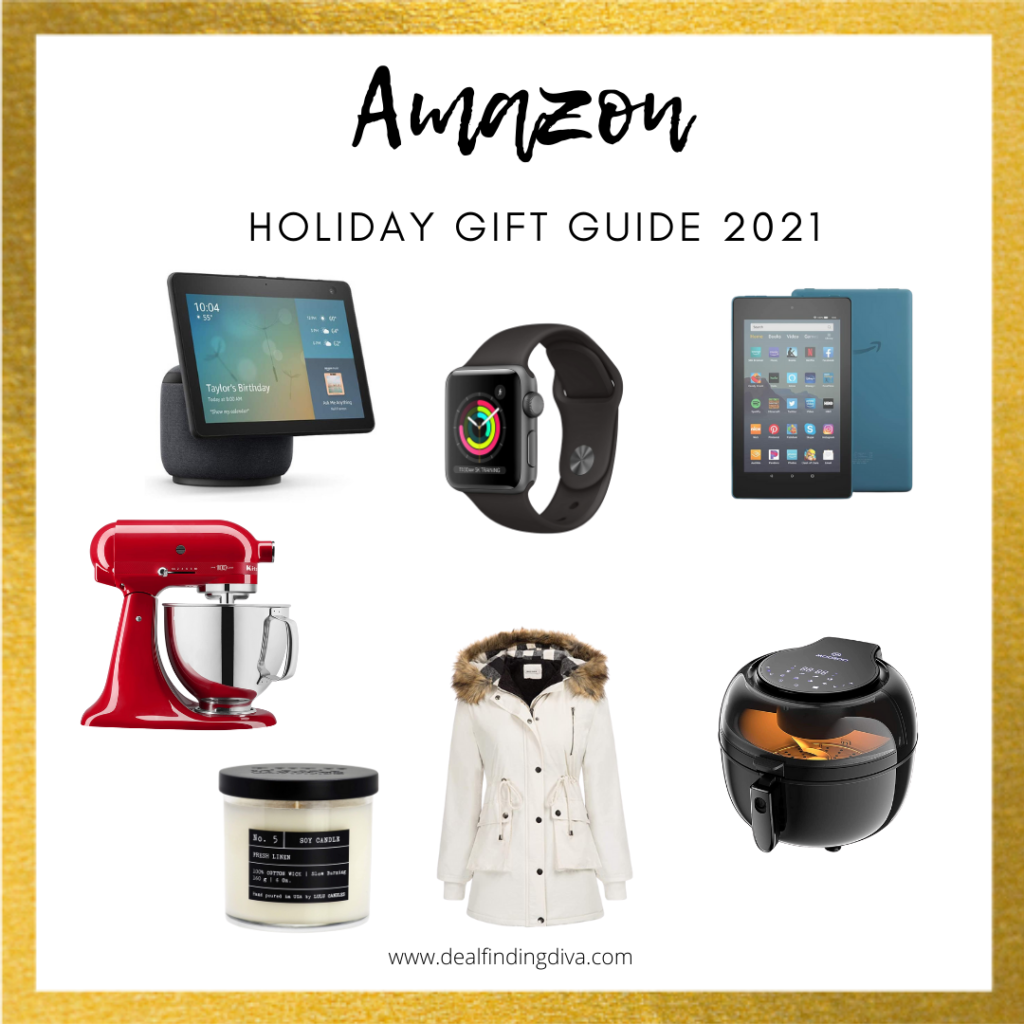

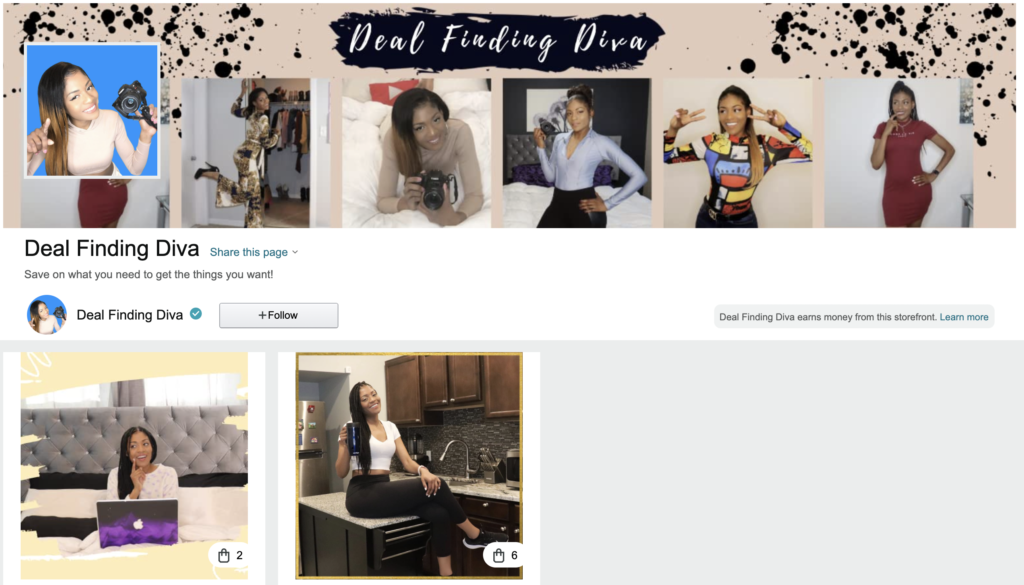

10. Follow My Amazon Page

To help you make the most of your holiday budgeting, I have created gift lists for every budget on my Amazon page. Some even allow you to pay using a payment plan with no credit check or interest. (One of my favorite features on Amazon.) Plus, I go live on Amazon and feature products that I like and would make great gifts.

So be sure to check out my Amazon page, and click the “follow” button over there so you don’t miss my next live stream.

Want to know how to get a free or discounted Amazon Prime membership? See this post.

When you have a hold on your holiday budgeting and need some holiday gift ideas, check out this awesome holiday gift guide!